Page 93 - Livre Beau Rivage Palace

P. 93

to the hotel’s fourth floor. Even so, it is difficult to estimate to were also delegation holders: what they would lose in interest, they would

50

54

what extent these investments helped boost winter business, which gain in dividends’. In 1887, the sio’s main financing partners were

saw an upturn at the beginning of the twentieth century. Other private banks, all based in Lausanne: Hoirs Sigismond Marcel,

factors, such as the favourable economic climate, the development Charles Bugnion, C. Carrard, Bory et Hollard, Edmond Tissot,

of winter sports and the influx of guests treated by Dr Combe, Ernst et Chappuis, Charles Bessières, and Charrière et Roguin.

probably also contributed to this revival. When the Palace was Despite the poor financial results recorded between 1875

built, the need for central heating was not disputed. Only the type and 1889 (table 2), the Beau-Rivage directors did not have

– steam or hot water – was debated. The steam model, which had too much difficulty meeting the costs incurred by the hotel’s

already proved itself, was finally chosen. 51 technical modernisation. During the period of 1877 to 1884,

which was marked by a certain technological conservatism,

FINANCING TECHNICAL MODERNISATION these transformations only represented an average annual cost of

55

Founded in 1857, the sio carried out a large amount of 2350 fr. Between 1885 and 1888, a first wave of alterations

development work on the port while building Beau-Rivage, (landing stage, external reservoir and hydraulic lift) prompted an

which opened its doors in 1861. The cost came to approximately increase in investments to 4770 fr., without causing any financial

2 million fr., the equivalent of 0.2 per cent of the Swiss gdp, difficulties. Things changed by the mid-1890s, with the installation

in 1861. Calculated on the 2005 gdp, it is the equivalent of a of electric lighting (108,474 fr.), quickly followed by the steam

52

staggering 702 million current Swiss francs. In order to meet this central heating system (26,000 fr.), and the installation of a kitchen

financial challenge, the developers raised a share capital of 1 million range, a goods lift, electric clocks and shutters. Between 1894 and

francs, on the basis of 4000 shares at 250 fr. each. A profile of the 1904, the average annual expenditure increased to 19,284 fr. Finally,

shareholders present at the annual general meetings between 1878 between 1905 and 1913, the combination of the Palace’s technical

and 1895 shows that the investors essentially came from Lausanne’s installations and the renovation works carried out on the original

prominent families. In great evidence on the board of directors, hotel caused the expenditure on technical equipment to shoot

banking circles were represented by members of the Bory, Marcel, up to 74,816 fr. a year. The new storage-battery electricity plant

Bugnion, la Harpe, Carrard, Bessières, de Charrière de Sévery, alone cost 170,000 fr., with almost the same amount again for the

Dubois, Roguin, Siber, Tissot and Chappuis families. They were equipment. How was this increase managed?

joined by a few notable and landowning families such as the As the graph of Beau-Rivage’s financial development shows,

Dapples, Dufour, Perdonnet, Auberjonois, de Loys, de Cérenville, the dramatic rise in expenditure on technological modernisation,

van Muyden, de Crousaz and Recordon families, and others from the mid-1890s, coincided with a phase of growth in revenues

active in trade and industry, such as the Boiceau, Mercier, Perrin (table 2). A significant proportion of the costs could therefore

and Sandoz families. At the end of the 1870s, the representatives of be met from the profits. The rest of the financial requirements

the 25 families named owned at least 1748 shares, or 44 per cent were covered by loans that were rapidly amortised. Financing for

of the share capital. These hard-core shareholders also took on the electricity plant, built in 1895, is a case in point. While the

53

the lion’s share of the mortgage (500,000 fr.) and bonded debts shareholders’ meeting had authorised a loan of 140,000 fr. to be

(525,000 fr.) taken out in 1860 and 1861. At the time of the debt’s taken out to meet the installation costs, the board of directors

conversion, in 1881, the board of directors felt that ‘what could also only borrowed 50,000 fr., and the rest came from the profits.

help this transformation is the fact that a good number of the shareholders By February 1897, the loan had already been paid back in full.

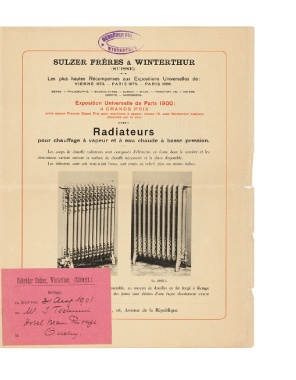

Fig. 10

Advertising for the Sulzer company of Winterthur which installed

the central heating at the Beau-Rivage in 1898.

92